Financial Sustainability vs Sustainable Finance

Clare Taylor discusses two financial elements which includes financial sustainability and sustainable finance. Clare shares the differences between both and why they both matter for your business.

Finance is one of the three pillars of sustainability, but one that is often overlooked by those at the beginning of their sustainability journey. The start point is usually environmental sustainability, especially as there is so much scope for cost savings in resource and energy reduction; properly recognising these savings from the start is important but doesn’t always happen. Social sustainability often follows as environmental programmes mature; this, too, is tied into finance and again often overlooked.

The two financial elements of sustainability could be considered to be ‘financial sustainability’ and ‘sustainable finance’: the differences are explored below, along with why they matter to your business.

Financial sustainability

A sustainable business needs to be effective commercially: not only financial management of business activities, but also of your sustainability programmes. Some savings can be overlooked if not systematically recorded, for example, as one of the benefits of LEDs is longer life, financial savings can include not having to hire platform cranes as often for changing lamps, and replacing an old boiler may not only make efficiency savings but also reduce repair call-outs.

Even if you are implementing a programme purely for its environmental or social benefits, measuring financial performance should form part of it. At a later date, you may find you need to demonstrate to bankers, investors or other stakeholders that your business can afford to continue it, or that there are non-financial benefits being created by it, or perhaps you enter for an award or certification and want to show what you’ve invested in a project.If your business management changes, a justification readily available for a new Finance Director makes life much easier: yes, we know it’s not paying for itself, but we know exactly what it costs and what it achieves.

Monitoring what you do and the outcomes, measuring inputs and performance or outputs and, where relevant, calculating returns on investment and payback periods all make the business case and provide information useful for calculating the viability of future programmes. For talking to those of us who, like me, struggle with reading balance sheets, a simple figure of ‘this is what it has cost us doing it this way over the past X years, and this is what it would have cost if we’d carried on business as usual’ can be very helpful for demonstrating financial benefit or balance.

If times get tight and something has to change, again you will have the data for making informed decisions; sometimes letting go of something can actually be the greater cost.

Sustainable finance

This is more about how you manage your finances: what your money is used for and how.

At a very basic level, the financial element of social sustainability includes fairness – paying suppliers in a timely way, paying staff a fair wage and charging customers fairly.

Going deeper, sustainable finances involve considering where your money goes and what it’s used for. What are the ethical practices of your bank, your insurers? If you have funds invested, what are they financing?

There are ethical current and deposit accounts available for businesses as well as for charities and individuals, and ethical investment funds. Choosing a bank or fund that implements ethical investment policies helps ensure that the money you have in your accounts is not being used for purposes that go against your sustainability policies or your own moral codes; with some schemes, it is simply what they do not invest in, others will actively invest for environmental or social purposes. Different organisations naturally have different screening policies for what they exclude from their portfolio, so you’ll need to research to find which work best for you and for your customer base. Such decisions can then be made according to your own ethos or that of your business, with the usual provisos for returns sought and the degree of risk acceptable.

One further benefit of investing sustainably is risk management. All investment affords risk, as we are so often warned, but some areas are potentially riskier than others. With regard to sustainability issues, a good example is the risks of stranded assets driven by carbon emissions regulation should your funds be heavily invested in fossil fuels. There are also risks of businesses or industries in which your funds are invested losing value because of boycotts driven by ethical concerns. Newspaper headlines about pollution, human rights abuses, malpractice or the like can easily lead to such boycotts or to calls for divestment. A sustainable investment policy can reduce these risks.

Cover image credit: 401(K) 2012

Topics

Recent news

Kodak's 2024 Sustainability Report: A Commitment to a Greener Future

Kodak's 2024 Sustainability Report, "One World, One Kodak," demonstrates a strong commitment to environmental and social responsibility. The report highlights impressive reductions in greenhouse gas emissions (56%) and water withdrawal (31%) and aims for zero waste by 2025. Notably, Kodak is pioneering double materiality assessment in the printing industry, aligning sustainability with financial reporting, and showcasing its products' environmental benefits.

How can printers lower costs on energy usage?

Clare Taylor outlines simple steps for businesses to achieve energy sustainability, focusing on cost savings and staff comfort. It emphasises starting with measuring energy consumption to identify key areas for improvement. Subsequent steps involve managing energy use through behavioral changes and low-cost interventions, like optimizing cooling settings and ensuring equipment is switched off when not needed.

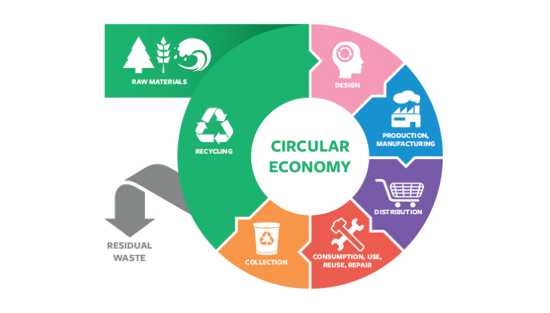

The European Union's circular economy plan

Printing companies must understand the EU's Circular Economy Action Plan (CEAP), part of the European Green Deal. These initiatives drive sustainability, impacting businesses globally, even if not EU-based, through customer requirements. Printers need to be aware of reporting and sustainability expectations to manage risks and retain clients.

A revised look at sustainability in wide format print

Sustainability is crucial for wide-format print, moving beyond marketing to an imperative driven by brands and regulations. Common "eco" claims often mask complexities; true sustainability demands carbon reduction as a core principle. Life Cycle Assessment (LCA) offers data-driven insights for genuine environmental improvement, as demonstrated by UFABRIK's transparent approach.