The path from recyclable to recycled

"Touting your packaging as simply recyclable isn’t good enough (and could even be considered greenwashing). Brands must simplify and standardise to enable closed loops at scale so packaging is recycled."

“Let me tell you about a big sustainability scam,”, teased a LinkedIn post recently: “plastic recycling.” It cited the example of Sweden where 80% of the plastic collected reportedly ends up burned, which reportedly produces to 8% of the country’s total carbon emissions.

Here in the UK it’s a similar story: a resources and waste progress report published by the government in November showed that 53% of residual waste (that endeding up buried or burned) consisted of “readily recyclable” materials. Of the plastic waste in there, 25% was easily recyclable; a further 31% will eventually be through new technologies such as chemical recycling.

This is of course an incredible waste of valuable resources – and it’s happening on a global scale.

Plastic projections

The OECD’s Gglobal Pplastic Ooutlook found that plastic production levels doubled between 2000 and 2019, with 460 million tonnes created in 2019. Currently just 9% of plastic packaging is recycled, while 50% is sent to landfill and 19% is incinerated. Most of the remaining 22% likely ends up polluting the natural environment.

The report also showed plastic’s heavy carbon footprint: 1.8Gt CO2e in 2019, which equates to 3.7% of global emissions. Polymers used for food packaging, bags and bottles were among the “highest emitters”. And while the emissions intensity of plastic production is projected to fall, this doesn’t compensate for increased use and waste with emissions set to hit 4.3Gt CO2e in 2060.

So business as usual is “unsustainable”, OECD noted, but there are ways to “bend the plastics curve” including policies that “restrain plastic demand and production, enhance recycling, and close leakage pathways”.

This is what the UK government is trying to do through policies like the plastics tax, Eextended Pproducer Rresponsibility (EPR) and a Ddeposit Rreturn Sscheme (DRS) for drinks containers. Together these new policies should reduce waste, increase recycling rates, improve packaging design, and see more recycled plastic displace virgin plastic. More materials should also be processed in the UK rather than sending them abroad.

“These policies should drive the use of more recyclable packaging and reduce the variety of materials we are dealing with,” said Richard Hinchcliffe from waste contractor Suez recently. “Imagine if all food trays were made of one material, like high density polyethylene (HDPE), for example, or if plastic bottles were clear – that would make a massive difference in terms of the economics of our business and the environmental impact of packaging.”

Standardisation at scale

The power of this simplification and streamlining of packaging should not be underestimated. Research by Eunomia, a consultancy, and Zero Waste Europe, showed that 60% of PET bottles are currently collected with 50% recycled; recycled content levels within ‘new’ bottles currently stands at only 17% however. Bottle-to-bottle closed loop recycling and deposit return schemes could help lift recycled content to around 61%. But if the opaque and coloured beverage bottles placed on the market are reduced by 91%, and replaced by clear and light blue bottles then 75% recycled content is possible.

Standardising and simplifying packaging can help us to scale closed loops, which has significant environmental benefits. The University of Cambridge Institute for Sustainability Leadership (CISL) has for example assessed different materials used for drinks against metrics like carbon emissions, water usage and recycled content. Not one material came out clearly as having the lowest relative impact in the areas examined, but “developing more circular systems, particularly to increase levels of recycling and the use of recycled content, can reduce the impact of all materials”.

Discussions around the standardisation of packaging are happening – but they might not be comfortable. Some brands spend millions on the design of their packaging to make it stand out on shelves, so the shape and colour and material are all incredibly important. Starbucks for example will want to use its iconic branding on a reusable cup but to be convenient (that is, you can collect a cup from one shop and return it to any other before it’s washed and returned for another cycle at a competing shop) but to be convenient, these reuse and refill schemes need to have standardised packaging. The logistics of returning different cups to different brands is too complicated.

We are starting to see some novel concepts as businesses start to understand the need for simplification and standardisation of packaging. One of the most recent is the label-less wine bottle launched in Australia. All the brand information is contained on the neck, which includes a QR code. Those involved say it’s part of rethinking packaging as the world moves towards minimisation and refill options.

There is progress elsewhere, too: of the rigid plastic packaging used by members of the UK Plastics Pact 92% is now recyclable while components that make the packaging hard to recycle have fallen by 90%. Recycled content has more than doubled and this has led to a 9% reduction in carbon emissions since 2018.

Brands are having to increase their recycled content in the face of plastics taxes and the voluntary commitments they have made. This brings their emissions down too. But it’s not always straightforward.

Flexible fiends

Flexible, multi-layered packaging has a fair amount going for it, such as low production and transportation costs; they are also lightweight and light in material use. The various materials used, such as polyester, aluminium, polyamide, and polypropylene, also have varying individual capacities to prevent the penetration of oil, oxygen, and moisture, helping reduce food waste by improving shelf-life.

But there is a problem. The layers are often laminated together and are difficult to recycle through traditional mechanical processes (the potential of chemical recycling to solve this remains unclear). Research company PreScouter noted recently in a blog for Packaging Europe that each layer of multi-material packaging has a specific purpose that now needs to be met by a single type of material, keeping the desired individual properties. Such innovation takes time – and money.

More progress will require further collaboration with upstream players, packaging converters, and recyclers. Consultants at McKinsey have noted the difficulties facing FMCG companies that have traditionally seen packaging sustainability through the narrow lens of lightweighting but are now having to address recyclability and carbon too – and sometimes they conflict with one another.

“We need more action to redesign plastic film packaging, rationalising around mono-polyolefins as far as possible,” according to Wrap. It could well be worth the pain: some companies to have adopted mono-material packaging report a 20% reduction in their carbon footprint compared to the industry production average, as well as over 10 times less water usage.

Companies have been criticised for the lack of progress when it comes to recycling flexible plastics in closed loops. Industry-led schemes have been scrutinised and there have been reports detailing how little of the plastic, now taken to thousands of collection points at supermarkets, is being recycled in closed loops rather than downcycled.

“We’re working really hard to increase the recyclability of our plastic packaging,” said Aimee Goldsmith, senior director, sustainability & company communications, P&G Northern Europe, recently. “The challenge for the whole industry is the proportion of packaging with a plastic film and the infrastructure needed in order to allow kerbside collection and an onward ability to then upcycle that material.”

Industry has to take the initiative due to delays on key policies like DRS and EPR and harmonised kerbside recycling collections. EPR will for example involve a fee structure in which harder to recycle materials will become more costly – but as yet the fees haven’t been set and the system has been delayed. It’s often difficult for brands to know which way to turn.

Open-minded

There have certainly been some controversial decisions with companies moving from plastic packaging that is recyclable in closed loops (HDPE milk bottles) to multi-material cartons that appear far trickier to recycle. The change reportedly saves emissions but without the full details of any life cycle assessments it’s hard to unpick.

Others are actually returning to plastics. Heura Foods, a manufacturer of plant-based meats, is one of those to have switched to plastics on the basis of a life cycle assessment (LCA) of its packaging. Its 2.0 packaging format was an 87% recycled cardboard tray and plastic coating (the challenges in recycling paper packaging with such layers was discussed in my previous article). But the company has now decided that a 92% recycled PET tray and plastic lid is better. Details of the LCA results from Spain, France, Italy and the UK were released showing that the rPET tray had between a 23% and 47% lower carbon footprint than the cardboard one. The use of recycled plastic in the trays (which are increasingly being recycled in closed loops) certainly helped swing the results in favour of the plastic. “We know it’s not the perfect solution but it’s the best one yet,” the company has said.

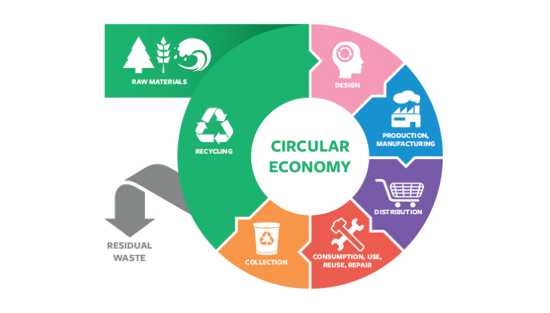

There is no perfect solution but the simpler and more standardised packaging becomes, the more chance of scaling the closed loops we need as part of a circular economy.

For more information on CarbonQuota and their services please visit here: https://www.carbonquota.co.uk/

Recent news

Kodak's 2024 Sustainability Report: A Commitment to a Greener Future

Kodak's 2024 Sustainability Report, "One World, One Kodak," demonstrates a strong commitment to environmental and social responsibility. The report highlights impressive reductions in greenhouse gas emissions (56%) and water withdrawal (31%) and aims for zero waste by 2025. Notably, Kodak is pioneering double materiality assessment in the printing industry, aligning sustainability with financial reporting, and showcasing its products' environmental benefits.

How can printers lower costs on energy usage?

Clare Taylor outlines simple steps for businesses to achieve energy sustainability, focusing on cost savings and staff comfort. It emphasises starting with measuring energy consumption to identify key areas for improvement. Subsequent steps involve managing energy use through behavioral changes and low-cost interventions, like optimizing cooling settings and ensuring equipment is switched off when not needed.

The European Union's circular economy plan

Printing companies must understand the EU's Circular Economy Action Plan (CEAP), part of the European Green Deal. These initiatives drive sustainability, impacting businesses globally, even if not EU-based, through customer requirements. Printers need to be aware of reporting and sustainability expectations to manage risks and retain clients.

A revised look at sustainability in wide format print

Sustainability is crucial for wide-format print, moving beyond marketing to an imperative driven by brands and regulations. Common "eco" claims often mask complexities; true sustainability demands carbon reduction as a core principle. Life Cycle Assessment (LCA) offers data-driven insights for genuine environmental improvement, as demonstrated by UFABRIK's transparent approach.