Will New Latex printers Revolutionise Business for Smaller Printers?

With the announcement of its smallest, lowest cost ever Latex printer, HP is going after the entry level wide format user market for the first time.

The new 1.3 metre (54 inch) Latex 310 is particularly aimed at design studios, offices and man-in-garage users (or woman of course) as well as anywhere that’s short of space. These prospective customers may have an aqueous printer already and want to move into outdoor media, textile banners, self-adhesive labels and so on, but without the perceived disadvantages of eco solvent, which range from a mixed environmental message to having to wait for outgassing to subside before lamination and finishing. Another office-friendly aspect is that these printers are particularly quiet.

The 310 is one of three printers in the new Latex 300 family, which collectively replace the 61 inch Latex 260 (originally launched as the Designjet L26500 and renamed last year).

“Having three machines in the market gives better breadth to the Latex range,” says Jane Rixon, business manager for HP Large Format Production Products in the UK & Ireland. “The 300 series now replaces the 260. The 360 in particular is twice the speed of the 260 for a similar price. The 330 and 360 are 64 inch printers, slightly wider than the 260.”

This third generation Latex ink was first seen in the big 3.2m Latex 3000 printer last year. Apart from the enhanced scratch resistance, it adopts a primer called an optimizing fluid, which in allows curing to take place at a lower temperature - some 10 to 15 Deg C lower for a given image/media combination, the company claims, though it still seems to run at over 100 Deg C. Mimaki and Ricoh claim 60 Deg C or lower for their Latex inks, which contain less water.

A recirculating hot air heater over the print zone replaces the radiant heater of earlier models. This cuts energy consumption and allows faster warm-up from sleep, so the printer can be powered down more frequently.

Lower temperatures also mean that thinner and more heat-sensitive media can be printed. “Previously the cheaper, thinner self-adhesive vinyls were tricky to print, but there’s no problem now,” says Rixon.

Power supplies are also addressed in the Latex 310, which plugs into a pair of ordinary domestic wall sockets, helping its office-friendliness. The 1.6m models need a heavier duty 16 amp industrial supply.

HP is claiming that its inks are “brighter” than eco sol, though other suppliers claim that their eco sol or SUV inks have a wider gamut. Prospective users would be wise to run side-by-side comparisons if this aspect matters to them.

Squaring up to eco sol

The European eco solvent market is dominated by Mimaki, Mutoh and Roland DG, with Epson trying to break in with its GS inks (for which it won’t use the word “solvent” at all).

HP, though big in aqueous and the upper reaches of solvent and UV, exited the low end, low/eco solvent market a while ago. It’s trying a new approach with the third generation Latex inks in the new models, which have highly scratch-resistant resins that it claims put them on a par with eco solvents for durability.

The Latex 310 list price is €13,500. The two 1.6m models, the 330 and 360, are priced at €17,500 and €22,500 respectively. You can look the speeds up, but they’re broadly the same as eco sol printers in the same size and price range. The 360 mainly differs from the 330 by having a built-in spectrophotometer for automatic media profiling, plus a catch gutter under the print zone so that textiles and meshes can be printed.

The other Latex supplier

Mimaki’s JV400, here seen in 1.6m SUV configuration with a curing lamp bar on the front. The same basic hardware is used for the Latex configuration, and is also adapted by Ricoh and Fujifilm.

Mimaki has been delivering its Latex ink JV400LX printer for more than a year, in 1.3m and 1.6m widths for around €22,000 and €24,500 respectively. It’s aiming them at different markets to the HP 300 family, according to Mike Horsten, Mimaki’s general manager marketing for EMEA. “We’ve never seen ourselves as competing with the general HP Latex printers,” he says. “We will always be considered a niche supplier in Latex. We have white and other colours, and they are CMYK. This lets us do transparencies and pastels that HP can’t. Ours are high end printers, not general eco sol alternatives.”

The Mimaki printers use Ricoh piezo heads, which explains why Ricoh sells more or less the same model under its own name as the Pro L4100. These heads have a very long life compared to HP’s thermal heads, but they cost a lot more. The seven HP heads cost €110 each and are warranted for at least 1 litre of ink, though Rixon says that the 300 family has less thermal stress than previous models so that up to 4 litres is feasible. The Ricoh heads potentially last the life of the printer if you look after them, but they cost about €2,000 each if you do need to replace them.

While both HP and Mimaki/Ricoh call their inks Latex, the formulations are different (partly so Mimaki can avoid HP’s patents). HP uses about 50% aqueous vehicle, while Mimaki’s LX100 ink is about 38 to 39%. Horsten says this means that the Mimaki printers use significantly less ink for a given job type, while the inks only differ in price by a few Euros per litre. HP’s list price is €128 for a 750ml cartridge and you need seven of them including the optimizer.

HP offers CMYK +lc +lm colours, while Mimaki has eight channels that can be variously divided between 2x CMYK or combinations of CMYK + white, orange or green.

Rixon says that HP costed out three of its standard text image types on a range of media from billboard to backlit and came up with €1.0 to €2.9 per m2.

SUV alternative

Colorific’s UV Light SUV cartridges, seen here in a Roland VersaArt RE-640 converted with the Colorific Lightbar UV curing lamp system.

Another reason for Mimaki regarding Latex as niche is that it can offer a choice of other ink types into this general purpose end of the market, including eco solvent, dye sublimation and SUV (solvent-UV hybrid). “HP says that it can work with textiles, but we say it’s better to have dye sublimation. For vehicle wraps, we say UV is better,” says Horsten.

For instance SUV inks are a particularly interesting new alternative to eco solvent, UV and Latex. They use a small amount of eco solvent carrier with UV cured polymers, giving an ink that’s very thin and glossy, with high durability, flexibility and scratch resistance and wait for degassing.

Mimaki says that its SUV version of the JV400 outsells the Latex version by about four to one. Colorific sells a similar SUV hybrid ink called UV light. This goes with its Lightbar UV curing lamp conversion kit, costing roughly €3,000 for a growing range of Mimaki, Roland and Mutoh eco sol printers (basically, anything fitted with Epson DX4, DX5 or DX6 printheads), most recently for the Roland VS 640i print and cut machine.

At FESPA Digital Fujifilm announced its own-label hybrid ink, FUZE, together with the 1.6m Vybrant F1600 printer, based on the Mimaki JV400LX.

It seems quite likely that all these SUV inks come out of Fujifilm’s Speciality Ink Systems factory in Broadstairs, England. So far none of the players have been willing to confirm this, but they haven’t denied it either.

All round appeal?

On the other hand, the HP one-printer-fits-all-media Latex message looks attractive, especially for start-ups or companies wanting to move from aqueous into outdoor work without going into solvent. It’s put a lot of effort into user help and support materials too.

There’s also the advantage of HP’s name and presence. “HP will sell Latex into this market because, well, it’s HP,” another rival supplier told us.

Its eco message resonates particularly well when selling to public sector organisations and other customers that have particular environmental policies to satisfy, or don’t want to use solvent or UV inks for various other reasons.

While HP has set itself the ambitious target of winning a 50% market share for Latex by 2016, it’s a bit vague as to how it’s actually defining this market. With important new launches in eco solvent coming at FESPA Digital 2016, as well as increasing options in SUV and low-energy LED-cured UV, prospective buyers are fortunate to have a healthy range of options.

Topics

Interested in joining our community?

Enquire today about joining your local FESPA Association or FESPA Direct

Recent news

Streamlining personalisation with tech: Insights from the SmartHub Conference 2025 speakers

Personalisation Experience 2025 (6 – 9 May 2025, Messe Berlin, Germany) is running its inaugural SmartHub Conference from 6 – 8 May 2025.

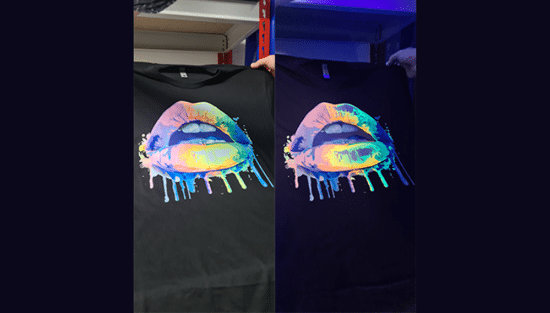

Special Effects in DTF: How Neon Inks Are Making Apparel Pop

Neon fluorescent inks are the latest innovation in DTF printing, offering vibrant, eye-catching effects under both daylight and UV light, giving apparel decorators a competitive edge. Testing shows good wash durability, though market perception of added value is still developing. With increasing adoption and ongoing technological advancements, neon represents a significant upgrade for creative customisation.

Unlocking Growth Opportunities in the Printed Personalised Apparel Industry

The printed personalised apparel industry is booming, projected to reach $10.1 billion by 2030. Driven by consumer desire for self-expression and branding needs, technological advancements like DTG/DTF and e-commerce integration are key. Sustainability, eco-friendly materials, and on-demand printing are crucial growth drivers. Businesses leveraging these trends, including AI and social media, have significant commercial potential.

How to grow your business with white ink applications

Opaque white ink is revolutionising signage, vehicle graphics, wallcoverings, short-run and wood packaging, and window blinds by enhancing vibrancy and clarity. This enables printers to offer high-demand, standout products, boosting profit margins. HP Latex white ink applications and their large format printing solutions will be showcased at FESPA 2025 in Berlin.