Processless plates take over

Processless plates make economic and environmental sense. Laurel Brunner believes the tipping point has finally been reached.

2014 was a watershed year for computer-to-plate (CtP) production: processless platesetting shifted up a gear, with all three major manufacturers making substantial headway in the market.

Processless plates make economic and environmental sense, because you simply image the plate and mount it on press. Simple. There are no chemical disposal costs or waste water to deal with, so significant reductions are to be had in water usage, waste production and energy consumption. Equally important you save time producing plates and the latest generation achieves decent results on press. What’s not to like?

The market now has a choice of three excellent direct on press plates, so printers really have no excuse for not making the move to processless. These plates aren’t quite as simple to output as a page from a desktop printer, but all they basically need is a thermal imagesetter imaging at 800 to 850nm. The convenience, cost savings and throughput improvements are why growing numbers of printers are going processless.

All three major plate manufacturers claim to be the market leader. Agfa has been in this sector for many years, with well over 10,000 installations, and recently introduced the new Azura TE, a direct on press plate for run lengths of 75,000+.

Most of the Agfa installations so far have been for the chemistry-free Azura offline plates. These require a clean-out unit before being ready for press, rather than being direct on press plates. Fujfilm has 3000 sites worldwide producing its PRO-T plate and is seeing consistent growth in customer numbers.

According to a spokesman “it is safe to say that PRO-T is still the number one processless plate in the market by a considerable margin”. That could start to change, given the speed with which Kodak’s Sonora has been adopted and the large installed Agfa customer base, many of whom are making the move to Azura TE.

Of the top three, Kodak is the most keen to publish installations data, and last July announced that there were 1000 customers using Sonora processless plates. Earlier this year Kodak said that there were over 1800 companies using the plate and that strong growth is expected to continue worldwide. The company’s North American customer base grew by 400% and its European one by 200% last year, as new customers invested in Sonora and existing ones switched from Kodak Thermal Direct.

Kodak is investing into new manufacturing facilities, anticipating that 2015 will see accelerating growth in its installed base. In Asia the company has over 200 customers and has upgraded its factory in Xiamen, China. In Latin America Sonora News plates account for some 35% of Kodak plate sales.

2015 will be the year of processless platesetting. We expect to see growth in conventional thermal plates plateau as more printers go processless. This can only help improve print’s already positive environmental impact.

Source: This article was produced by the Verdigris project, an industry initiative intended to raise awareness of print’s positive environmental impact. This commentary helps printing companies keep up to date with environmental standards, and how environmentally friendly business management can help improve their bottom lines. Verdigris is supported by the following companies: Agfa Graphics, Spindrift.click, EFI, FESPA, HP, Kodak, Kornit Digital, Ricoh, Splash PR, Unity Publishing and Xeikon.

Topics

Interested in joining our community?

Enquire today about joining your local FESPA Association or FESPA Direct

Recent news

Streamlining personalisation with tech: Insights from the SmartHub Conference 2025 speakers

Personalisation Experience 2025 (6 – 9 May 2025, Messe Berlin, Germany) is running its inaugural SmartHub Conference from 6 – 8 May 2025.

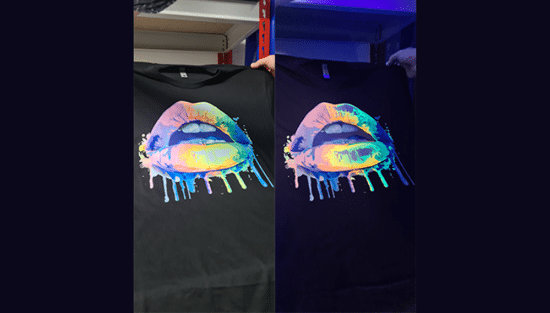

Special Effects in DTF: How Neon Inks Are Making Apparel Pop

Neon fluorescent inks are the latest innovation in DTF printing, offering vibrant, eye-catching effects under both daylight and UV light, giving apparel decorators a competitive edge. Testing shows good wash durability, though market perception of added value is still developing. With increasing adoption and ongoing technological advancements, neon represents a significant upgrade for creative customisation.

Unlocking Growth Opportunities in the Printed Personalised Apparel Industry

The printed personalised apparel industry is booming, projected to reach $10.1 billion by 2030. Driven by consumer desire for self-expression and branding needs, technological advancements like DTG/DTF and e-commerce integration are key. Sustainability, eco-friendly materials, and on-demand printing are crucial growth drivers. Businesses leveraging these trends, including AI and social media, have significant commercial potential.

How to grow your business with white ink applications

Opaque white ink is revolutionising signage, vehicle graphics, wallcoverings, short-run and wood packaging, and window blinds by enhancing vibrancy and clarity. This enables printers to offer high-demand, standout products, boosting profit margins. HP Latex white ink applications and their large format printing solutions will be showcased at FESPA 2025 in Berlin.