The wide format print sector is being shaped by several key trends, including a move toward larger, more automated presses for efficiency. Nessan Cleary describes how the industry is also seeing a need for both affordable eco-solvent printers and new applications like Direct-to-Film (DtF) to generate revenue. Finally, sustainability remains a significant driver for innovation.

It’s tempting to see wide format printing as being more of the same each year, but with better image quality and faster print speeds. And while there is some truth in this, it’s also useful to see the underlying trends, which are driven partly by technical improvements but mainly by external market factors. These trends ebb and flow from year to year, pulled as much by economic factors changing our priorities as anything else. Print service providers need to be tuned into these trends when choosing which direction to take their business and what to invest in for any given year.

This is more true this year than any other because of the uncertainty created by the American tariffs and the risk of trade wars between nations. This has a direct impact on the price of equipment and spare parts and, most crucially, inkjet inks that are so reliant on rare earth minerals for their colourants. On top of this, there is still persistent inflation in many countries, which affects consumer spending and therefore advertising, including display graphics.

All this feeds into the wide format market in a number of different ways. This year’s Fespa Global show in Berlin underlined a trend towards bigger, higher volume presses, as print service providers look to consolidate their printer fleet and streamline their processes to squeeze out every last efficiency saving they can.

There are now two single pass presses designed specifically for the wide format market display graphics market, both derived from machines built for the packaging printing. The first of these was the EFI Nozomi, available in two sizes as the 1.8m wide 18000+LED and the 1.4m wide 14000 SD. These use UV inks with speeds of up to 59 linear m/m. These both have a native print resolution of 360 dpi but EFI claims an apparent resolution of 805 dpi.

Fujifilm has now started taking orders for its Aristo series, which include both the HS6000 and HS3000, which use water-based inks. The HS6000 has been adapted directly from Barberán’s JetMaster while the HS3000 is more of a simplification, leading to a much smaller print unit. The HS6000 can produce up to 80mpm, while the HS3000 is slower at 50mpm.

Fujifilm also launched a brand new 3.3m wide hybrid printer this year, the Acuity Ultra Hybrid Pro. Fujifilm is quoting productivity of 600 sqm/hr in rollfed mode and over 100 beds per hour. This is part of another trend as Kevin Jenner, European marketing manager for Fujifilm Ink Solutions, explained: “The market is moving more towards hybrid. People are looking for a machine that does anything and they want something with no compromise.”

There are also a couple of presses that are close to single pass. Durst has developed the P5 SMP or Super Multi Pass, which it bills as an alternative to single pass. This is based around the P5 350 chassis as a 3.5m wide hybrid but Durst says that it can produce up to 1940 sqm/hr and around 5 million sqm per year.

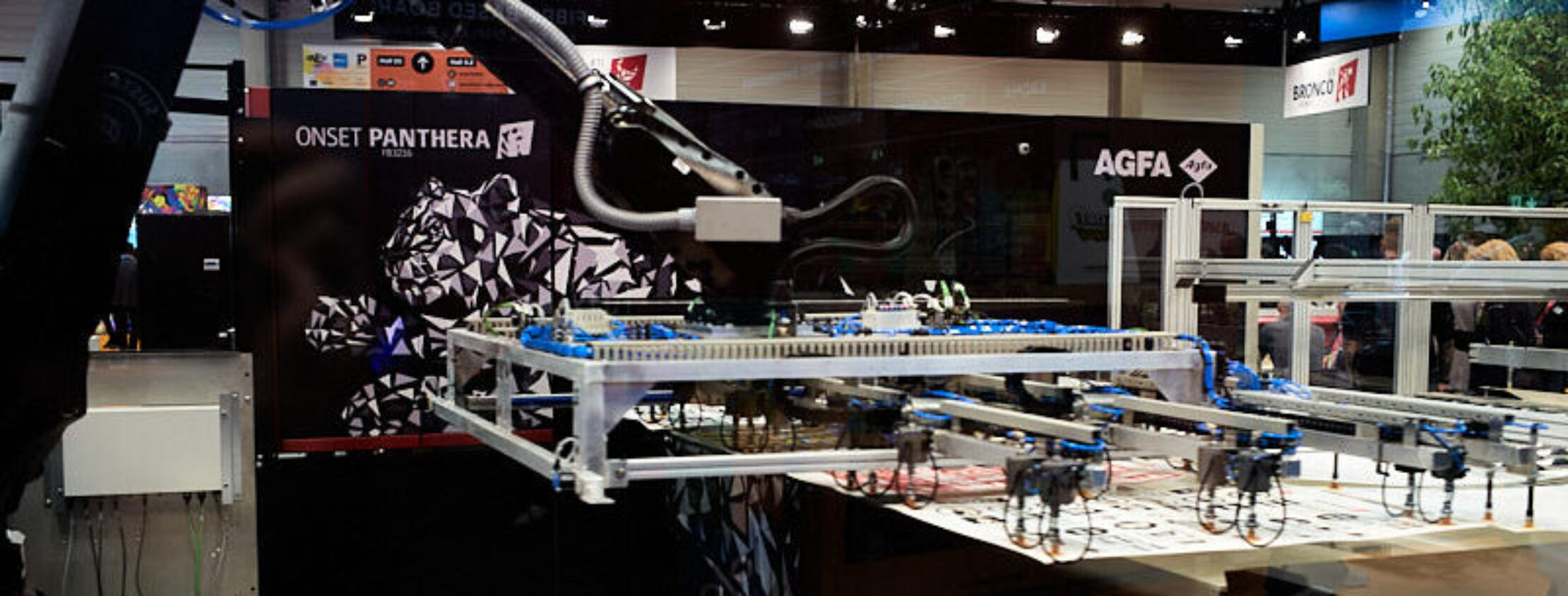

Agfa continues to sell the Onset series, developed by Inca Digital, and now configured with LED lamps and Agfa inks. Although the print heads cover the full width of the bed it’s more common to use multiple passes to improve the resolution and image density. Express mode with two passes takes under nine seconds and the new Onset can produce up to 1449 sqm/hr. For this year’s Fespa show, Agfa demonstrated an autoloader complete with robotic arm for automatic unloading.

Agfa also showed off the latest of its Tauro 3.2m hybrid printers, the XUHS, which has gained more printheads – up from 64 to 96 Ricoh MH5420 heads – to increase the productivity. There are still eight channels, so these can be loaded with either two sets of CMYK or CMYK plus an extra black and three light versions of cyan, magenta and black. There are also white, varnish and primer options, which require a further 24 printheads.

This is part of another trend, towards greater use of automation to increase productivity and overall throughput. Robotic arms are now becoming more commonplace, for both printers and cutting tables, in a bid to optimise equipment efficiency for the maximum throughput.

Despite this need for higher productivity, there does also seem to be a continuing need for affordable roll-fed eco-solvent printers. Thus, Mimaki has just introduced the JV200-160, a 1.6m wide roll-to-roll eco-solvent printer with a practical production speed of 17 sqm/h. There’s also a 1.3m wide version. It uses the new SS22 eco-solvent ink, that is free of GBL chemicals and is said to reduce odour by approximately 40 percent.

Earlier this year Roland DG introduced the XP640 eco-solvent printer. It uses a new eight-colour TH2 inkset that includes a new red as well as light black, orange and green plus CMYK for a wider colour gamut. It can also be configured with two sets of CMYK for faster print speeds.

Epson also has a new eco-solvent printer, the SC-S8100, which is a 64-inch signage printer. It gains a a new, larger PrecisionCore MicroTFP printhead so that productivity can be increased by up to 30 percent depending on material type, when compared with the outgoing SC-S60600.

The other big trend from this year’s Fespa Global event is the continuing need for print service providers to search out new applications and new revenue streams – to be able to offer something new to customers to help drive up profits – but with relatively low capital investment cost. This is helping print service providers to appeal to a different, more consumer-orientated, customer base. The margins per job are often quite small, but the volume of jobs should compensate for this.

This includes Direct-to-Film, using water-based inks to print to film transfers for textile use, which continues to grow apace. But at this year’s show there were also a number of UV DtF solutions, which uses UV inks and is more suitable for decorating objects rather than textile printing. This fits in with a general trend towards more personalisation, allowing consumers to personalise everything from mobile phone cases through to home decor for a relatively low cost.

Finally, the ongoing trend towards greater sustainability shows no sign of slowing down. This is particularly noticeable around recycling materials to reduce the carbon footprint of print projects. Brands and corporate customers are increasingly building their own efforts at sustainability into their messaging, meaning that there is now more demand for print service providers to come up with eco—friendly solutions. This is also helped by the growing availability of materials that are made with recycled content, which has helped to cut prices for such options.