The apparel market shifts towards automation and the nearshoring of textiles

Debbie McKeegan discusses how sewing robots, speed factories and digital printing are pioneering the way forward as machines and artificial intelligence take a grip on our imagination and expectations.

Textiles and automation are no strangers, forty years ago Schlafhorst and Rieter were using robots to make piercings on every spinning frame that they sold, and Colour Kitchens from Van Wyk and Stork produced millions of litres per annum of custom ink formulations, on demand, perfectly mixed and milli-metrically accurate.

.jpg?lang=en-GB)

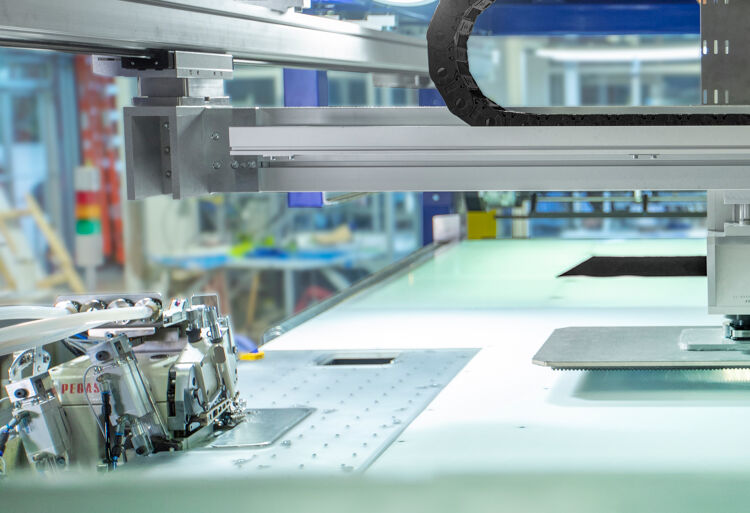

Caption: The Digital agenda has moved on and it is Sewing Robots, Speed factories and Digital Printing that are pioneering the way forward as machines and artificial intelligence take a grip on our imagination and expectations.Credit: Softwear Automation.

Now the agenda has moved on and it is Sewing Robots, Speed factories and Digital Printing that are pioneering the way forward as machines and artificial intelligence take a grip on our imagination and expectations.

As these disruptive technologies take hold, the perpetual quest of the Textile Industry for cheaper and cheaper labour sources seems set to end, as a new market dominated by customisation, personalisation and sustainability lays down the agenda for a new way forward.

Conceptually, the Textile Industry of the future is perceived as one in which factories hardly consume water, energy or chemicals, where labour is nearshored and upskilled to shorten the supply chain thereby reducing the environmental impact of long distance product travel, and where, driven by the new technologies, Textile production is symbiotically linked to actual demand, dramatically reducing the overstocks that populate our landfills at this time.

In the Global Apparel Industry, which employs over 80 million people worldwide, Sewing continues to be the most labour-intensive production process.

In the past, the Textile Sewing Sector has been able to rely on developing economies to satisfy their search for low labour costs to fund their supply equation.

However, as a recent survey in China showed, developing economy labour costs have tripled in 15 years, showing that this model is exhausted, and with their comparative advantage eroded, these developing economies no longer have the solution.

Caption: Pete Santora, Chief Commercial Officer: Softwear Automation is disrupting the $100 billion sewn products industry by creating autonomous sewn goods production lines for Home Goods, Apparel and Footwear. Credit: Softwear Automation.

In the eighties, mass-market apparel brands couldn’t move their production quick enough to Asia, where low labour costs gave them exemplary profits.

This strategy morphed in the early 2000’s as China’s competitive advantage faded, and production was moved on to low cost frontier economies such as Vietnam, Cambodia, Ethiopia and Algeria.

These moves were met with considerable success as it became obvious that all these economies could deliver products that consumers wanted, at prices they could afford, whilst still maintaining speed of delivery, high quality, and regulatory compliance.

Yet now, as Internet shopping and Ecommerce have made competition more cutthroat, and demand more changeable than ever, these world brands have had to look at the competition and react.

In this maelstrom of change, the competition is now on-line start-ups, web-shops and young brands driven by strong internet and social media presence, who can dictate hot styles on a daily rather than a seasonal basis, and can deliver their product, at the right price, the right quality and the right look, to their clients within hours.

Small wonder that Some of the biggest brands in the global apparel industry, which employs as many as 75 million people worldwide, are exploring automation.

Sportswear giant Adidas already has fully automated factories operating in Germany and the US, it expects these new so-called Speed factories to ramp up production and reduce manufacturing lead times for product to a matter of days.

.jpg?lang=en-GB)

Caption: TY Garments will employ 400 people in Arkansas and produce an annual volume of over 100 million garments. The facility features 330 robots designed by Softwear Automation and 21 automated assembly lines.Credit: Softwear Automation.

In 2019, TY Garments USA started production, with an investment of 20 million-dollars in a state-of-the-art production plant in Little Rock, Arkansas.

TY Garments will employ 400 people in Arkansas and produce an annual volume of over 100 million garments.

The facility features 330 robots designed by Softwear Automation and 21 automated assembly lines.

On an eight-hour shift, a sewing robot equipped with sensors and cameras can produce over a thousand T-shirts.

By way of comparison, a 10-person crew working on a standard production line can only produce 669 T-shirts in the same amount of time.

For TY CEO Tang Xinhong, the factory is a milestone in the company’s history, and he is convinced that: “Around the world, even the cheapest labour market can’t compete with us.”

The US-based clothing company Levi Strauss & Co. has patent protection for an automated laser solution for finishing its jeans. The contrast between the previous finishing process and the new one is a striking illustration of the potential of automation.

In the new system, a pair of jeans can be laser finished in 90 seconds, as opposed to the 20 minutes that these operations took previously.

These examples show why tomorrow’s successful apparel companies will attempt to enhance the apparel value chain in three ways, nearshoring sustainability and automation.

But so far they have lagged behind in the adopting nearshoring and automation partially because they have continued to rely on low-cost Asian sourcing , but also because of the technical and financial challenges for only recently have fully-automated solutions for sewing become market-ready.

But now, as on-demand production gains importance and technologies develop, automation is becoming critically important for the main players and there will be a steady stream of developments over the next few years reflecting this.

The recent report by McKinsey on the State of Fashion 2019 predicted this that to meet customer’s needs, apparel companies need to focus on nearshoring, automation and sustainability.

Mckinsey say that within five years semi -automated factories will be ‘lighthouse’ projects for most of the apparel brands and that within ten years fully automated factories will enable full nearshoring of production.

Citing five significant textile automation areas, Mckinsey suggest that special attention is paid to progress being made in Sewing Automation, Intra-Logistics Automation, Digital Printing, Gluing & Bonding And Knitting.

The end result will definitely be a migration of jobs from the traditional low-cost manufacturing countries to the developed economies of the Industrial world, recent estimates have suggested that this could men an additional 150,000 jobs in the USA alone.

The automation of the Textile Industry however, is only symptomatic of a world-wide trend, Robot Systems are set for a meteoric rise over the next few years, with a recent market report suggesting a CAGR of 37.4% will take place between now and 2025.

This will result in a rise of the value of installed robots from $39.3bn in 2017 to $498.4bn in 2025, a staggering fact that bears out Oxford Economics prediction that 20 million manufacturing jobs will be lost by 2030.

Equally, it predicts that in the UK alone robots will generate an additional £5bn of GDP, as well as creating as many jobs as are lost.

But for Textiles, the story is still the same, as the pressure for smaller batch sizes and on-demand replenishment grows, they will have to rise to the challenge embrace the new technologies and re-equip to keep their cost base and commercial offers intact.

Topics

Interested in joining our community?

Enquire today about joining your local FESPA Association or FESPA Direct

Recent news

WrapFest returns to Silverstone amid vehicle customisation boom

WrapFest, the dedicated show for the vehicle and surface decoration community will return to the prestigious Silverstone Race Circuit this year, running from 3-4 October 2024.

Opportunities for large formt printers in labelling

Nessan Cleary shares how labelling can present a unique opportunity for large format print suppliers who are looking to grow and diversify their business.

.png?width=550)